- How do you measure business financial health?

- Financial health definitions

- How to maintain and improve your financial health

- Closely monitor key performance indicators (KPIs)

- Keep an eye on customer acquisition costs and customer lifetime value

- Leverage the power of discount codes and coupons

- Financial forecasting and budgeting

- Scenario planning

- Think of sustainability

- Analyze market trends, competitor strategies, and customer behaviors

- Improve user experience and satisfaction

- Implement different subscription models

- Cultivate a strong brand reputation

- Diversify your revenue streams

- Financial literacy training

- The 50/30/20 rule

- Revamping the operational model

- Conclusion

Financial health refers to the state of an individual’s or business’s monetary well-being, encompassing various elements such as income, expenses, savings, debt, and investments. While the specifics of financial health can vary depending on personal or business circumstances, the core principles remain consistent.

For some, it may be defined by a steady income and manageable debt, while others might prioritize substantial savings and diverse investments. Regardless of these nuances, maintaining good financial health is crucial as it ensures stability and prepares one to meet future financial goals effectively.

9 out of 10 eCommerce businesses go out of business in the first few months post-launch. While this statistic can be attributed to a number of factors, there’s one element that keeps popping up – poor financial strategy. Being in good financial health helps businesses stay afloat in the risky business that is eCommerce.

For eCommerce sellers, maintaining robust financial health is particularly important. The dynamic nature of the eCommerce industry, marked by fluctuating market trends and consumer behaviors, demands a strong financial foundation. Good financial health enables eCommerce businesses to manage cash flow efficiently, invest in growth opportunities, and weather unexpected financial storms. By focusing on financial health, eCommerce sellers can achieve sustainable growth, enhance their operational efficiency, and ensure long-term success in a competitive market.

How do you measure business financial health?

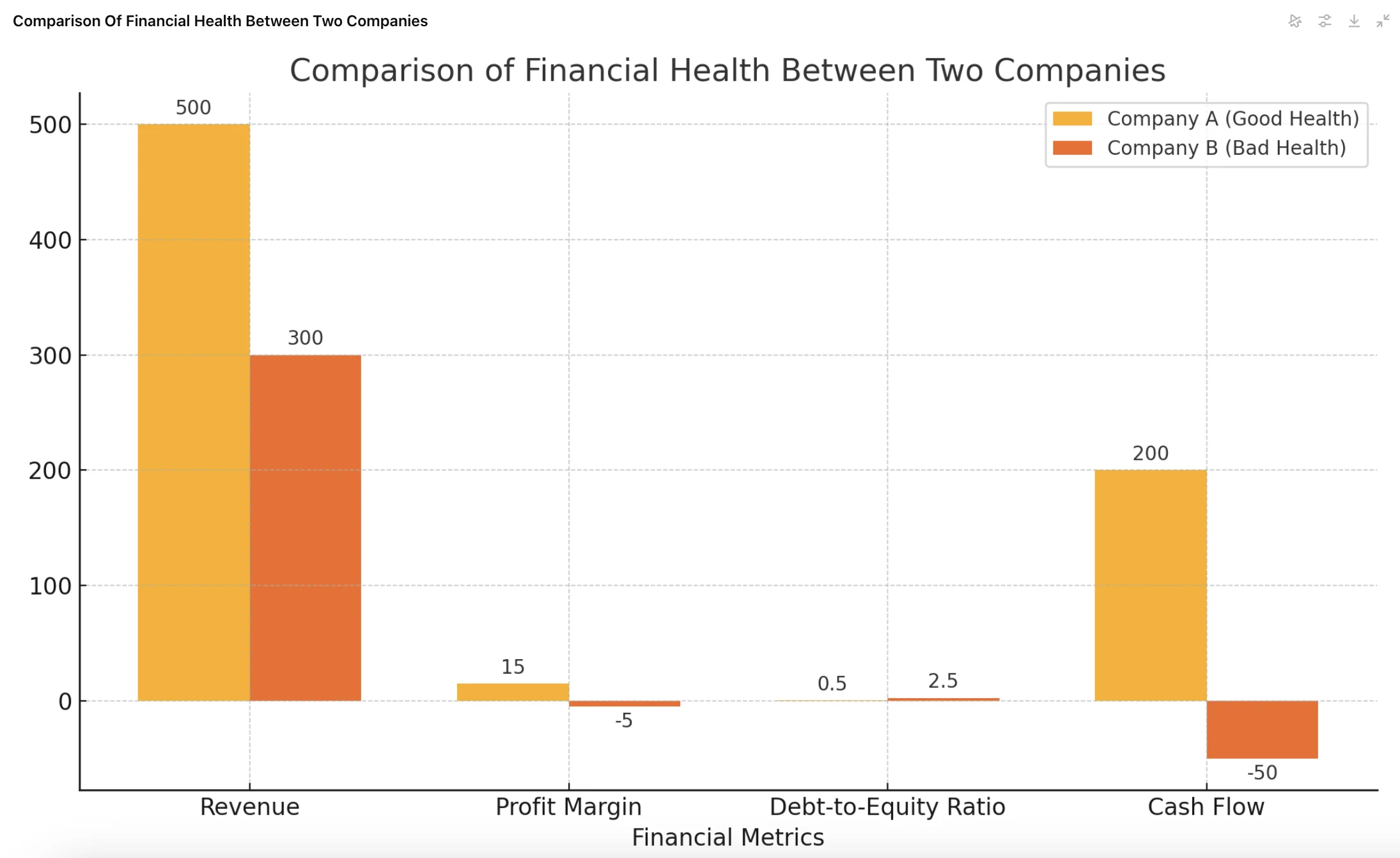

According to Investopedia, the best way to measure financial health is by examining several financial metrics in combination, including liquidity, solvency, profitability, and operating efficiency. Among these, the level of profitability, particularly net margin, is perhaps the most significant indicator of a company’s overall health and long-term viability. This comprehensive approach ensures a holistic view of a company’s stability and sustainability.

Financial health definitions

Financial health refers to the state of one’s personal financial situation, encompassing the ability to manage day-to-day finances, absorb financial shocks, meet financial goals, and have the financial freedom to make choices that enhance one’s quality of life. It includes having control over your financial activities, such as budgeting, saving, and investing, to ensure both present and future financial security.

This definition synthesizes the common elements found in various sources, which emphasize financial control, the ability to handle unexpected expenses, progress toward financial goals, and the freedom to make financial decisions without stress.

While the term ‘financial health’ can be defined in many different ways, there are some aspects of it that most leading eCommerce sellers and experts agree on. We’ve asked them about their definition of financial health. Here are their answers:

Subscribe to the eCommerce newsletter for

top industry insights

For Oleg Segal, founder and CEO of DealA, “a financially healthy company would have a good credit score, a balanced mix of customers, and a track record of consistent growth.”

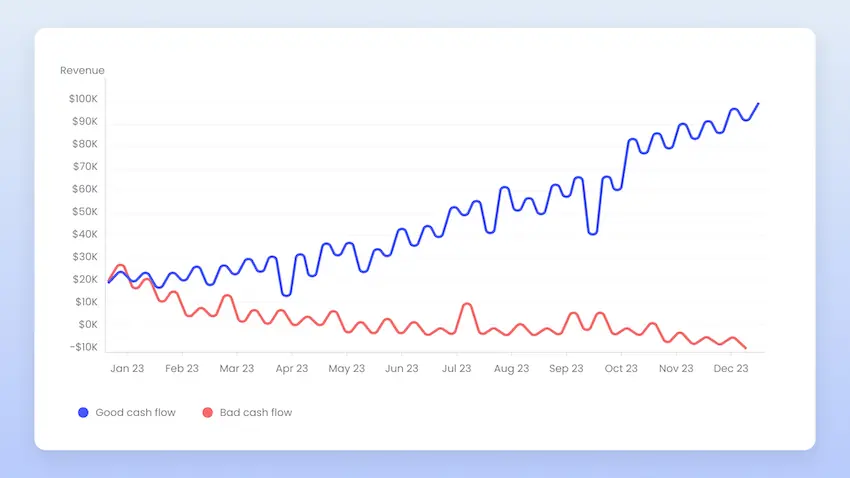

Financial health is really about maintaining a steady cash flow, managing operating costs efficiently, and achieving sustainable profit margins.

Oleg Segal Founder and CEO, DealA

Guillaume Drew, founder and CEO of Or & Zon, thinks of financial health as a “multidimensional concept.” He says: “In my perspective, financial health is not just about profitability, but also involves a healthy cash flow, sustainability of the business model, and even the capacity to develop and grow.”

Financial health is about a blend of performance metrics and risk considerations that reflect the overall health and viability of a business.

Guillaume Drew Founder and CEO, Or & Zon

Nick Drewe, founder and CEO of Wethrift: “It’s about striking a balance between your short-term operational requirements and long-term expansion goals, all while ensuring that profitability is consistently preserved.”

Financial health is a combination of liquidity, growth potential, and sustainable profitability.

Nick Drewe Founder and CEO, Wethrift

Riccardo Ocleppo, founder and CEO of OPIT:

Financial health is a balance between profitability, liquidity, efficiency, and stability. They are all interrelated and should be addressed simultaneously for the overall financial health of an organization.

Riccardo Ocleppo Founder and CEO, OPIT and Docsity

Abhi Madan, co-founder and creative director of Amarra, thinks that “while profitability represents the basic business survival indicator, liquidity allows for immediate responsiveness to market trends and growth emphasizes the business’s future viability.”

Financial health is a balanced blend of profitability, liquidity, and growth potential.

Abhi Madan Co-founder and creative director, Amarra

Brandon Galici, certified financial planner from Galici Financial, believes that financial health is “a constant balance of meeting current needs and wants while building a secure financial foundation for the long term.”

Financial health isn’t a destination, but a journey. It’s about using your money in ways that are important to you in the present while also preparing for your future.

Brandon Galici Certified financial planner, Galici Financial

Niels Hoeben, founder of Frankster:

Financial health is the ability to grow sustainable and profitable by managing cash flow effectively – ensuring a healthy balance between investment and returns.

Niels Hoeben Founder, Frankster

George Yang, founder and chief product designer of YR Fitness, says: “financial health refers to the stability, security, and growth prospects of one’s finances.”

When it comes to an eCommerce business, this means having a solid base built on well-managed cash flow, good balance between income and expenses, and the ability to invest in growing without damaging financial stability.

George Yang Founder and chief product designer, YR Fitness

Ian Jennings, founder of Harbour View Mortgages and a qualified financial advisor (QFA) and CFA Charterholder, says that “financial health is the state of one’s finances, reflecting stability, security, and the ability to meet current and future obligations.”

[Financial health] encompasses income, savings, investments, debt management, and the capacity to handle financial shocks.

Ian Jennings Qualified financial advisor (QFA) and CFA Charterholder

Firdaus Syazwani, founder of Dollar Bureau and Corporate Cover: “[Financial health is] about balancing cash flow, minimizing financial risks, and maximizing investment returns, to ensure the business can thrive even in volatile markets.”

Financial health, to me, is the ability to sustain operational efficiency and profitability without compromising future growth opportunities.

Firdaus Syazwani Founder, Dollar Bureau and Corporate Cover

Dr. Saurabh Mirajkar, experienced Ayurvedic physician at Order Your Supplies, says that financial health “is like a recipe – it’s all about the right ingredients and the perfect balance. Metrics such as savings rate, debt-to-income ratio, net worth, and cash flow serve as the key ingredients.”

- For instance, a healthy savings rate typically ranges from 15% to 20% of one’s income, while a debt-to-income ratio below 36% is considered favorable.

- Net worth, which is the difference between assets and liabilities, is a key indicator of overall financial health.

- Maintaining positive cash flow, where income exceeds expenses, is essential for financial stability and growth.

Dr. Saurabh Mirajkar Experienced Ayurvedic physician, Order Your Supplies

As we’ve seen, most eCommerce sellers and experts think the same – there’s a very delicate balance between managing day-to-day finances, ensuring liquidity, achieving sustainable profitability, and preparing for growth.

Financial health is about maintaining steady cash flow, balancing short-term needs with long-term goals, and continuously managing risks and opportunities for future security.

Might also interest you:

- How to increase your Amazon sales

- How to increase your eCommerce conversion rate

- Bookkeeping and finances for eCommerce sellers

How to maintain and improve your financial health

eCommerce sellers all have their own ways of keeping their businesses financially healthy. Read on to learn what top industry individuals do to stay stable in unstable situations:

- Monitor KPIs regularly to adjust strategies

- Balance customer acquisition costs with lifetime value

- Use discount codes to boost sales and customer loyalty

- Employ financial forecasting and budgeting to manage resources effectively

- Prepare for various outcomes with scenario planning

- Integrate sustainability into your financial model for long-term success

- Analyze market trends and competitors

- Enhance user experience to increase conversion rates

- Offer subscription models for predictable revenue

- Build a strong brand reputation to foster customer trust and loyalty

- Diversify revenue streams to reduce risk and ensure financial stability

- Invest in financial literacy training to promote informed decision-making

- Apply the 50/30/20 budgeting rule for balanced financial management

- Revamp operational models to streamline processes

1. Closely monitor key performance indicators (KPIs)

Key performance indicators (KPIs) are vital metrics that help eCommerce businesses measure their progress toward achieving financial and operational goals. By monitoring KPIs such as gross profit margin, net profit margin, customer acquisition cost, and customer lifetime value, businesses can gain valuable insights into their financial health.

These metrics enable eCommerce sellers to make informed decisions, identify areas for improvement, and track the effectiveness of their strategies. Regularly reviewing and adjusting based on these indicators ensures that businesses remain competitive and sustainable in the dynamic eCommerce landscape.

Oleg Segal: “[At DealA, we] rely heavily on key performance indicators including gross margin, net profit margin, and cash conversion cycle.”

Guillaume Drew: “At Or & Zon, we maintain our financial health by consistently monitoring KPIs including gross profit margin, conversion rate, customer acquisition cost, and average order value.”

Riccardo Ocleppo: “[We maintain financial health by] rigorously monitoring key metrics like the cash conversion cycle (CCC), net profit margin, and the debt-equity ratio.”

Brandon Galici: “A simple yet helpful strategy to maintain your financial health is to monitor these metrics quarterly. This allows you to quickly identify if your financial actions are effective. For example, if your goal is to pay off debt, you should see your debt rate decrease and your net worth increase over time. If this isn’t the case, it would be a signal to take a deeper look at your financial situation (maybe you are paying off some debt but have a spending issue).”

2. Keep an eye on customer acquisition costs and customer lifetime value

Understanding and managing customer acquisition costs (CAC) and customer lifetime value (CLV) are crucial for maintaining financial health in eCommerce. CAC refers to the total cost of acquiring a new customer, including marketing and sales expenses. In contrast, CLV represents the total revenue a business can expect from a single customer over their entire relationship. Balancing these metrics ensures that the cost of acquiring customers does not outweigh the revenue they generate, leading to sustainable profitability.

By optimizing marketing strategies to reduce CAC and enhancing customer experience to increase CLV, businesses can achieve a more efficient and profitable operation.

Nick Drewe: “Key metrics that I follow include gross and net profit margins, cost of customer acquisition, and customer lifetime value. I believe keeping a close track of these indicators helps in making informed, data-driven decisions for the business performance and financial sustainability.”

Popular content

- 14 strategies to improve your eCommerce business’s financial health

- 50+ ChatGPT prompts to elevate your eCommerce business

- A guide to pricing your product on Amazon

- 5 marketing metrics all eCommerce businesses should track

- All about Amazon PPC

Niels Hoeben: “Maintaining financial health for Frankster involves meticulous attention to key metrics such as customer acquisition cost, lifetime value of customers, and gross margin. Additionally, we closely monitor inventory turnover, return on advertising spend, and operating cash flow. We track this on a daily basis.”

3. Leverage the power of discount codes and coupons

Discount codes and coupons are powerful tools for driving customer engagement and boosting sales in eCommerce. These promotional strategies incentivize purchases by offering customers immediate savings, thereby increasing the likelihood of conversion.

By strategically implementing discount codes and coupons, businesses can attract new customers, encourage repeat purchases, and enhance customer loyalty. Additionally, these promotions can help clear out excess inventory and stimulate sales during slow periods. When used effectively, discount codes and coupons can significantly contribute to a business’s financial health by improving cash flow and fostering a loyal customer base.

Oleg Segal: “A unique strategy we utilize is leveraging the power of discount codes and coupons, to increase customer engagement and loyalty, which ultimately contributes to our long-term financial health by creating repeat customers and predictable revenue streams.”

4. Financial forecasting and budgeting

Financial forecasting and budgeting are essential practices for ensuring the long-term financial health of an eCommerce business. Forecasting involves predicting future revenue, expenses, and financial needs based on historical data and market trends, allowing businesses to make informed decisions and plan for various scenarios. Budgeting, on the other hand, involves creating a detailed financial plan that outlines expected income and expenditures over a specific period.

Together, these tools help businesses allocate resources effectively, manage cash flow, and set realistic financial goals. By regularly updating forecasts and budgets, eCommerce sellers can anticipate challenges, seize growth opportunities, and maintain a stable financial foundation.

Guillaume Drew: “We apply a forward-looking approach by employing robust financial forecasting and budgeting, enabling us to anticipate market trends and make informed business decisions.”

5. Scenario planning

Scenario planning is a strategic method used by businesses to prepare for potential future events by considering various possible outcomes. This approach involves creating detailed and plausible scenarios that reflect different market conditions and business decisions.

By envisioning these scenarios, companies can develop flexible strategies to respond effectively to changes and uncertainties in their environment. Scenario planning helps organizations anticipate challenges, identify opportunities, and make informed decisions that support long-term financial health and stability.

George Yang: “One of the interesting strategies we have engaged in at YR Fitness is scenario planning. This creates different financial scenarios against various market conditions and business decisions. This could help to be prepared for different outcomes, thereby sailing through uncertainties with strategic decisions to entail long-term financial health.”

6. Think of sustainability

Integrating sustainability into the financial model is increasingly vital for eCommerce businesses aiming for long-term success. Sustainable financial practices involve balancing profitability with social and environmental responsibility. This can include adopting eco-friendly processes, sourcing materials ethically, and minimizing waste.

Such practices not only reduce costs and improve efficiency but also attract environmentally conscious consumers, enhancing brand loyalty and reputation. By embedding sustainability into their financial strategy, businesses can ensure they are not only financially robust but also contributing positively to the planet and society, paving the way for a sustainable future.

Guillaume Drew: “One interesting strategy we use is integrating sustainability into our financial model. By leveraging direct sourcing from artisans worldwide, we are able to maintain superior product quality while also optimizing our cost structure. This approach not only enhances our financial health but also contributes to our sustainable and ethical business objectives.”

Abhi Madan: “One unique strategy that has worked for Amarra, is an investment in sustainable fashion, essentially fostering ethical consumerism while enhancing brand loyalty.”

7. Analyze market trends, competitor strategies, and customer behaviors

Analyzing market trends, competitor strategies, and customer behaviors is crucial for maintaining financial health in eCommerce. Keeping abreast of market trends helps businesses anticipate changes and adapt their strategies accordingly, ensuring they remain relevant and competitive. Studying competitor strategies offers insights into successful tactics and potential pitfalls, enabling businesses to refine their own approaches.

Understanding customer behaviors, including purchasing patterns and preferences, allows eCommerce sellers to tailor their offerings and marketing efforts to better meet customer needs. By continually analyzing these factors, businesses can make informed decisions, optimize operations, and enhance their financial performance in a dynamic market.

Nick Drewe: “Financial health in the eCommerce realm can be maintained through regular analysis of market trends, competitor strategies, and customer behaviors. Upholding adaptability in your business strategy and constantly testing new marketing efforts can contribute massively to ensuring your financial health.”

Riccardo Ocleppo: “We have a unique strategy wherein we utilize data-driven insights to align our eCommerce initiatives with market trends, minimize costs, and maximize profitability.”

8. Improve user experience and satisfaction

Enhancing user experience and satisfaction is fundamental for the financial health of eCommerce businesses. A positive user experience ensures that customers find the website easy to navigate, visually appealing, and responsive – which significantly boosts conversion rates. Satisfied customers are more likely to return for future purchases and recommend the business to others, fostering loyalty and generating repeat revenue.

Key strategies for improving user experience include optimizing website speed, simplifying the checkout process, providing excellent customer support, and personalizing the shopping experience. By prioritizing user satisfaction, eCommerce businesses can build a strong, loyal customer base and secure consistent revenue streams.

Nick Drewe: “Improving user experience is another key strategy that I employ – a happy customer is a repeat customer, and repeat customers drive more dependable revenue streams.”

9. Implement different subscription models

Offering diverse subscription models can significantly enhance the financial health of eCommerce businesses. Subscription models offer predictable and recurring revenue streams, which contribute to financial stability and growth. By providing various subscription options, such as monthly, quarterly, or annual plans, businesses can cater to different customer preferences and budgets.

This approach also fosters customer loyalty and retention, as subscribers are more likely to continue purchasing over time. Additionally, subscription models can help businesses manage inventory and cash flow more effectively by predicting demand. Overall, leveraging subscription services can lead to a more reliable and sustainable financial foundation for eCommerce sellers.

Riccardo Ocleppo: “With Docsity, we’ve instituted an unconventional yet highly effective subscription model. Instead of demanding high fees upfront, we distribute the financial burden by providing students with affordable monthly payment options, ensuring steady cash flow for us and easy access to resources for our users. Our financial health strategy places a strong emphasis on sustainability, innovation, and continuous adaptation to the market needs.”

10. Cultivate a strong brand reputation

Cultivating a strong brand reputation is essential for maintaining financial health in eCommerce. A reputable brand builds trust and credibility with customers, which translates to increased customer loyalty and repeat business. Key strategies for enhancing brand reputation include delivering consistent and high-quality products, providing exceptional customer service, and engaging authentically with customers on various platforms.

Positive reviews, testimonials, and word-of-mouth referrals further strengthen a brand’s image. By prioritizing brand reputation, eCommerce businesses can differentiate themselves from competitors, attract and retain customers, and achieve sustainable financial success.

Abhi Madan: “While I keep an eye on key metrics like cash flow, profit margin, and inventory turnover, I equally emphasize cultivating a strong brand reputation and ensuring customer satisfaction, as these aspects often drive long-term success.”

11. Diversify your revenue streams

Diversifying your revenue streams is a crucial strategy for achieving financial stability and reducing risk. By generating income from multiple sources rather than relying on a single stream, businesses can mitigate the impact of market fluctuations and economic downturns.

This approach not only provides a more stable financial base but also opens up new opportunities for growth and expansion. Additionally, having an emergency reserve fund in place can help manage unplanned expenses, further ensuring long-term financial health and resilience.

George Yang: “Another point emphasized by us has always been on diversification in the streams of revenue so that it doesn’t get dependent upon a single source of income. The approach brings down the risks involved and gives one a more stable financial base.”

12. Financial literacy training

Financial literacy training equips individuals with the knowledge and skills needed to manage finances effectively. By understanding key financial principles, employees can make informed decisions that contribute to both personal and organizational financial health.

This training fosters a culture of financial awareness, ensuring that everyone is aware of the importance of good financial practices and their role in maintaining financial stability. Through financial literacy training, businesses can promote a more financially responsible and proactive workforce.

George Yang: “We’re also putting in place some financial literacy training for our team so that everyone understands how vital good financial health is, and does their part to sustain it.”

13. The 50/30/20 rule

The 50/30/20 rule is a straightforward budgeting strategy designed to help individuals manage their finances effectively. According to this rule, 50% of your income should be allocated to essential needs, such as housing, utilities, and groceries. Another 30% is reserved for personal wants, including dining out, entertainment, and hobbies. The remaining 20% is dedicated to savings and debt repayment, ensuring that you are planning for future financial security while managing current expenses. This method offers a balanced approach to budgeting, making it easier to maintain financial stability and achieve long-term financial goals.

Ian Jennings: “An interesting strategy I use is the ’50/30/20 rule’ for budgeting: 50% of income for needs, 30% for wants, and 20% for savings and debt repayment. This simple framework helps balance current lifestyle with future financial security.”

14. Revamping the operational model

Revamping the operational model of a business involves restructuring processes to enhance efficiency and profitability. By prioritizing automation and outsourcing non-core tasks, companies can significantly reduce overhead costs and streamline their operations.

This strategic pivot not only minimizes manual labor and operational complexities but also allows businesses to focus on their core competencies. The result is often a substantial increase in profit margins and overall business performance, demonstrating the effectiveness of modernizing and optimizing operational models.

Firdaus Syazwani: “One standout example from my ventures involves revamping the operational model of an eCommerce business to prioritize automation and outsource non-core tasks. This pivot significantly reduced overheads and streamlined operations, leading to a 40% increase in profit margins within the first six months.”

Conclusion

Maintaining good financial health is essential for eCommerce businesses to thrive in a competitive market. Financial health encompasses the ability to manage daily finances, absorb financial shocks, and achieve long-term financial goals. This includes maintaining control over budgeting, saving, and investing to ensure stability and preparedness for future financial needs.

Successful eCommerce sellers highlight the importance of financial health in managing cash flow, investing in growth opportunities, and withstanding economic uncertainties. By focusing on key performance indicators and leveraging strategies like discount codes, sustainability, and customer satisfaction, these businesses achieve sustainable growth and operational efficiency.

At 8fig, we understand the critical role financial health plays in the success of your eCommerce business. Let us help you navigate the complexities of eCommerce finance with flexible funding and the right financial management tools, ensuring your business remains resilient and prosperous in any market condition.

Have article ideas, requests, or collaboration proposals? Reach out to us at editor@8fig.co – we’d love to hear from you.

- New technologies that are changing the eCommerce fashion industry – everything you need to know

- Why just-in-time funding is the future for eCommerce

- BFCM: The ultimate guide to eCommerce sales [2024]

- 7 reasons successful eCommerce sellers opt for funding to fuel growth instead of relying on profits

- What is singles’ day? All you need to know about 11.11

She's a former English teacher who's passionate about the written word, all while embracing the AI revolution and its countless benefits.

Subscribe to the eCommerce newsletter for

top industry insights

to our blog

Read the latest

from 8fig

Learn how to fine-tune your supply chain for the holiday season with expert tips on forecasting demand, managing suppliers, and optimizing logistics. This guide is here to help you avoid common pitfalls and set your eCommerce business up for success during peak periods and beyond.

Video ads can make or break your eCommerce success. Learn five essential strategies to create high-converting campaigns that captivate and convert.

Personalization isn’t just a trend – it’s the key to eCommerce success. Discover how tailored strategies drive conversions, foster loyalty, and set your store apart.