Successful eCommerce business owners are constantly working towards growth. However, with the demands of supply chain and marketing expenses, the day to day costs of running your business, and unexpected setbacks, it can be hard to keep up without external eCommerce funding. A business line of credit is one popular way for eCommerce sellers to access the capital they need to grow.

Fund your inventory with 8fig!

Like a credit card, a line of credit, or LOC, is a predetermined amount of money from which you can take funds when you need, as long as you don’t surpass the limit. As you repay the funds you borrow, you can borrow money again up to the borrowing limit. It’s a great short-term solution for an eCommerce business’s needs.

Read on to learn more about lines of credit as well as the pros and cons of using one to fund your business.

What is a business line of credit?

A business line of credit is a type of loan that gives you continuous access to a set sum of money. You can take out funds as needed to cover your short term business expenses, as long as you remain within the limit.

As you repay the money you borrow, it becomes available to you again. This is known as a revolving account, or an open-end credit account. With this type of credit arrangement, you can continue to borrow money, then repay it, and then borrow it again in an endless cycle.

You will also have to pay interest on your LOC, but unlike a loan, you only pay interest on the funds you actually take out. This can help keep your costs down while giving you access to just the right amount of funding right when you need it. Most lines of credit have a variable interest rate, which means that it can change over time based on the market. Therefore, your interest payments can go up or down, depending on the global economic conditions and other market factors.

What’s the difference between a line of credit and an installment loan?

A line of credit and an installment loan are two different ways to fund your business. When you take out an installment loan, you receive a one-time lump sum of capital that you then must pay back to the lender according to an agreed-upon schedule. With a line of credit, however, you have continuous access to capital as you need it up to a set limit.

One of the biggest differences between an installment loan and an LOC is the flexibility that an LOC offers. You can choose when and how much money you borrow, depending on how much you need. The repayment terms are also more flexible than the set repayment schedule of a loan. With an LOC, you can decide to pay off the entire balance or just make minimum payments depending on your cash flow and financial situation.

We’ll ask a few quick questions to better understand your specific business needs. Then, we’ll build a funding plan tailored to your expenses.

Subscribe to the eCommerce newsletter for

top industry insights

These differences impact your interest payments as well. With an installment loan, you generally start accumulating interest right away. You’ll have to pay interest on the entire amount of money you borrow, whether or not you use it, too. When you use an LOC, on the other hand, you only pay interest on the amount of capital you take out at any given time.

Might also interest you:

Types of business lines of credit

There are two main types of line of credit available to businesses. Although they function similarly in many ways, there are also several important differences.

Pro tip

There are two main types of business line of credit: a secured LLC which requires collateral and an unsecured LOC which does not require collateral.

Secured business line of credit

In order to qualify for a secured business line of credit, you must have a valuable asset to use as collateral. Depending on your lender, you may be able to use your inventory or even accounts receivable as collateral. Since it’s an LOC for businesses, you won’t have to pledge your personal assets like real estate or property. If you fail to pay off the line of credit, the lender has the right to seize the collateral.

Secured business LOCs often have higher credit limits and lower rates due to the collateral involved. However, this is only available to businesses with suitable assets, and not everyone wants to take the risk of putting up collateral.

Unsecured business line of credit

An unsecured business line of credit is the more popular option for business owners in search of an LOC. Collateral is not required for an unsecured business LOC, but it comes with other requirements.

Since the lender takes on a riskier investment when there’s no collateral involved, the other requirements are often quite strict. You will most likely need to have good personal and business credit, as well as a solid business history. If your business is just starting out, or if your credit score isn’t high enough, you may struggle to qualify for this type of LOC. In addition, the lending limits are often lower and the interest rates higher due to the lack of collateral.

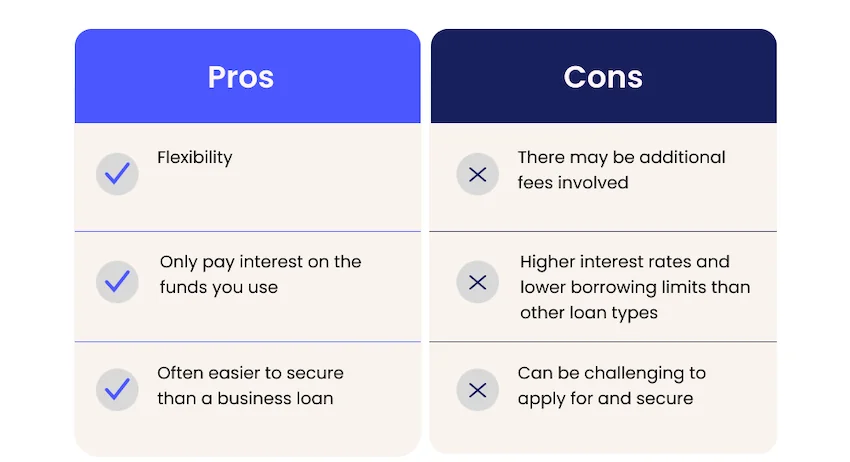

The pros and cons of a line of credit

Securing a line of credit for your business has its benefits and drawbacks, just like any eCommerce financing solution. It’s important to gain a thorough understanding of how a line of credit can help your business as well as the challenges you might face when you open one.

Pros of an LOC

Flexibility

The main benefit of a business line of credit is its built-in flexibility. You can take out money when you need it, instead of waiting for another loan to be approved. There is even some flexibility regarding how you pay back your funds, as you can choose between a minimum payment or pay off the full balance.

In addition, as long as you’re using your line of credit for legitimate business purposes, there are no restrictions on how you spend the funds. This flexibility makes an LOC an attractive option for businesses that need a periodic cash flow boost.

Only pay interest on the funds you use

When you open a line of credit, you only pay interest on the funds you actually use. It doesn’t matter how high your credit limit may be, if you don’t take out the funds, you don’t have to pay interest on them. This is not true of installment loans, in which you pay back interest on the entire balance of your loan whether or not you are actually using the money you borrowed. It can help keep your payments down, especially if you only need to use a portion of the credit limit.

Faster and easier to secure than a business loan

Opening a business line of credit is most often faster and easier than applying for a business loan. You’ll still have to meet certain eligibility requirements, but they tend to be more lenient than those of other types of business loans. This allows some small businesses to secure funding even when they struggle with loan approval.

Business LOCs also usually take less time to secure than bank loans, so if you need money relatively quickly, it can be a good choice.

Builds business credit

Building credit is important if you want to secure better borrowing terms in the future. A business line of credit can help you do so. As long as you use the funds according to the terms of your agreement and pay them back on time, your business’s credit score will increase.

Cons of an LOC

It can be challenging to apply for and secure

Business lines of credit can take time and effort to apply for. More often than not, lenders will ask you for a number of documents and reports, such as financial statements, revenue reports, tax returns, personal credit history, and more. They also may ask you to show two years of business history in order to qualify.

If you’re a new business owner and don’t have the financial documents or credit history required, you may be out of luck. In addition, if you need funds right away, you may not have the time to complete the application process and wait for approval. In those cases, an alternative funding source might be preferable.

Popular content

View articles

There may be fees involved

Make sure to read the terms and conditions of any line of credit carefully, because there are often a number of fees involved. Sometimes, lenders charge origination fees, withdrawal fees, and maintenance fees, which can add up quickly. This is of course in addition to your interest rate.

It’s also important to pay off your funds on time, or you risk further fees. Failure to pay on time also damages your credit rating.

Higher interest rates than other types of loans

Business lines of credit often have higher interest rates than business installment loans. This is in part due to the more lenient requirements, and is the cost you pay for the flexibility you get with a line of credit.

Low borrowing limits

Compared to other financing options, business lines of credits often have low borrowing limits. They are not designed to provide businesses with large sums of money at one time, instead serving as a short-term cash flow solution. If you need a big sum of money for a costly product launch, another type of loan or funding solution is probably more fitting.

Plan your restock accurately with 8fig

8fig: A different kind of funding solution

Business lines of credit certainly have their benefits, but they’re not the best solution for every eCommerce business.

If you’re a successful eCommerce seller in need of more funds than a line of credit can offer, or if you’re looking for a funding solution that can really help you grow your business, 8fig might be able to help.

8fig is a unique funding and growth platform designed specifically for eCommerce businesses. We offer fast and flexible funding plans that are personalized to your individual needs. Our funding is continuous, so you’ll get regular cash deposits aligned to your supply chain costs. This optimizes your cash flow and ensures you have capital on hand when you need it. What’s more, 8fig provides you with a number of tools invaluable to planning and managing your business. Check it out here.

Have article ideas, requests, or collaboration proposals? Reach out to us at editor@8fig.co – we’d love to hear from you.