The internet has completely changed how we go about buying and selling things. More and more consumers are turning to online shopping, making eCommerce an increasingly profitable business for many entrepreneurs. COVID-19 helped things along, as people all over the world bought more goods from the comfort of their couch. But there is one major hurdle that any hopeful online brand owner has to solve in order to scale: funding.

Funding isn’t just a hurdle at the start of an eCommerce business plan. Once your shop is up and running, you’ll need constant cash flow to order inventory, run effective advertising, optimize your supply chain, and innovate your products. Luckily, sellers have a lot of options when it comes to securing eCommerce funding.

So which eCommerce financing option is best? It ultimately comes down to the unique needs of your business. We’re here to help you better understand the funding options available. Then, you can decide which will help you scale your store to new heights. Keep reading to learn the pros and cons of each of the following funding options:

Why eCommerce funding matters so much

There are a number of costs that go into starting an eCommerce business, and sellers need plenty of funding in order to succeed.

While you don’t need to pay for a brick-and-mortar store, online shops have their own unique costs. For example, sellers typically need to pay a fee to host their store on an online platform.

They also need to pay third parties to handle certain aspects of their businesses for them, and warehouses for inventory storage also require regular payments.

And then there is the entire supply chain to consider. Unless you’re a small seller making goods on your own, you’ll need to make a deal with a manufacturer. Then, you’ll need to partner with a vendor and a shipping company to move the goods from one place to the next. There are also other aspects of supply management that start to come into play as a shop grows, such as expensive inventory management software.

eCommerce businesses do not have to pay for the same things as physical businesses, but there are lots of unique logistical challenges. All of them require funding. Most sellers don’t have the cash on hand to pay for all of these things, and that’s where funding platforms come in.

Deciding which funding option to choose is the hard part. Let’s take a look at some of the most common options and compare a few of them.

Subscribe to the eCommerce newsletter for

top industry insights

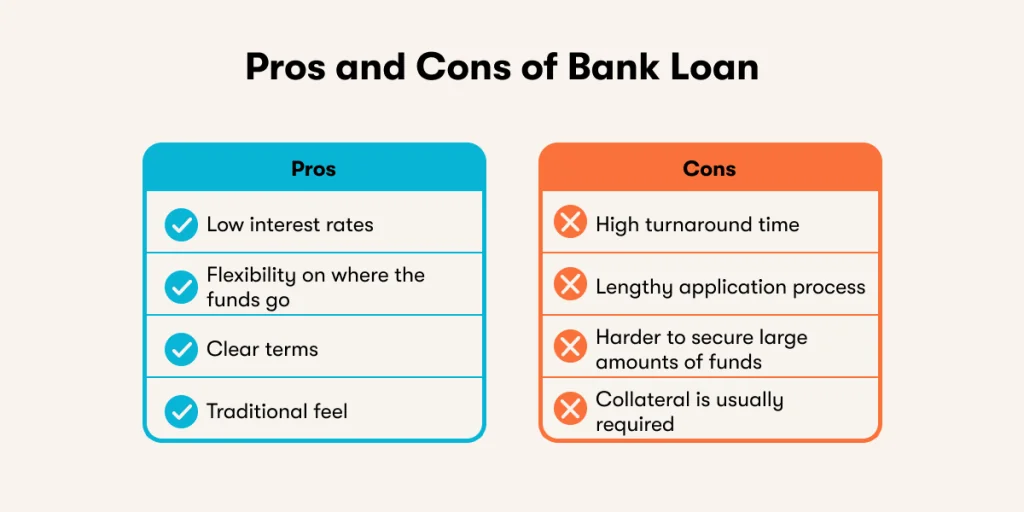

Traditional bank loans

Back in the day, bank loans were the only option if you wanted money for your business. Things have changed now, but there are still plenty of reasons why you might opt for one.

A bank loan is when you walk into a bank with an application saying that you need money for a certain purpose. The bank will look at your application and your credit and determine whether or not to loan you money. If they do, you will get the funds that you need to start building and growing your business.

Like any other loan, the bank will expect the money back, with interest. That means you can expect to pay back more than you borrowed, so there’s a cost for the loan.

That isn’t always a bad thing, though. Paying back a loan can reflect positively on your credit score. In addition, if you grow your business with the money, you should have no trouble paying it back.

The advantage of bank loans is that they typically have lower interest rates than loans from private sources. Since banks have so much money – and so much insurance on the money – they can take on more risk than other sources. So if you’re looking for the cheapest way to get funds, a traditional bank loan could be the way to go.

However, you should also consider the fact that banks don’t typically give out huge sums of money. Bank loans can also take a while, so they aren’t the best option if you are hoping to get funds as quickly as possible.

Here’s a quick look at some pros and cons before we move on:

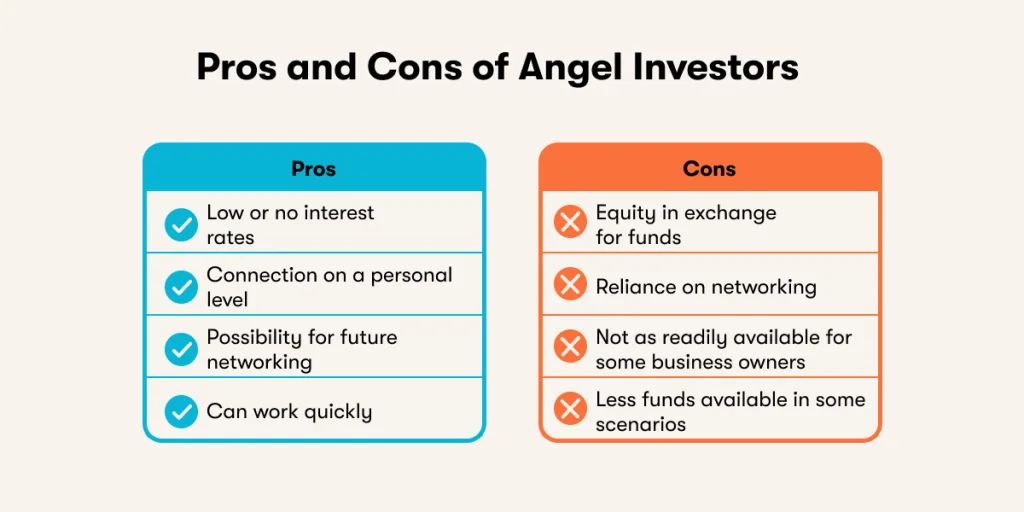

Angel investors

Another way that many business owners secure funding is through angel investors. This is the kind of investment that we often hear about in the media: a wealthy individual swoops in and funds a business simply because they believe in its potential.

It might sound like a long shot, but it can actually be a reasonable way to fund a business. Many start-ups start pursuing angel investors after they go through a round of friend and family investment. Securing an angel investment involves giving presentations and a lot of networking. When done correctly, though, it can really help boost a business.

A good way to find angel investors is to connect with people who are already in your circle. By the time your eCommerce business has been running for a while, you have likely connected with individuals who may be interested in investing in your company.

It can feel a bit awkward to ask friends and mentors for an investment, but you never know who will want to fund your idea. Don’t be afraid to start looking for leads within your own network.

The challenge with angel investors is that funding isn’t guaranteed. If you can’t find anyone interested in your shop, you’re out of luck. It’s a great strategy for those who are good at networking or already have a lot of connections, but it won’t work well if that’s not you.

Another important consideration is the fact that angel investors will typically give you funds in exchange for a percentage of the business, known as equity. If you want your eCommerce shop to be completely yours, angel investors should probably be avoided.

Here are some of the pros and cons of using angel investors as a source of funding:

Might also interest you:

- Why just-in-time funding is the future for eCommerce

- 7 reasons successful eCommerce sellers opt for funding to fuel growth instead of relying on profits

- 4 key eCommerce funding challenges and how to overcome them

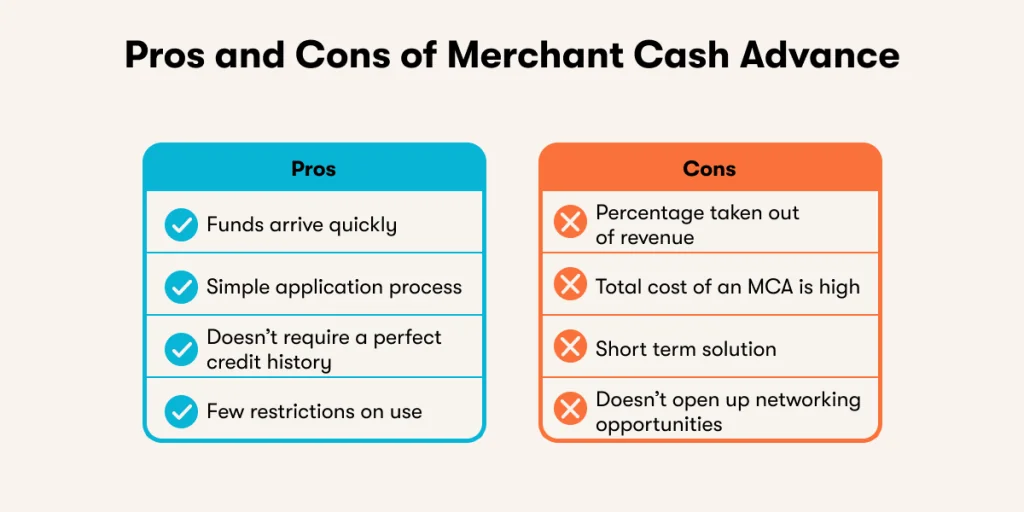

Merchant cash advance

A merchant cash advance (MCA) is a successful funding method for many eCommerce businesses. They’re largely considered one of the easiest and most convenient ways of getting funding.

An MCA is capital given to a business that is then repaid through the revenue that the business brings in. A business owner applies for an MCA, and then the MCA company works with a bank to determine a good funding fit. This is typically based on how much credit card revenue the business is bringing in.

Once this is calculated, a portion of every credit card sale in the business will be taken out and put towards paying back the MCA. That means that until the loan is fully repaid, sellers can expect to make slightly less revenue than normal.

Of course, that is also true with almost every other kind of funding. Since an MCA relies on your business performance rather than your personal financial history, it is a much better option for some people. MCAs are also known to be fast and efficient, so if you need money quickly, an MCA could work for you.

An MCA is also a great option for those who aren’t quite sure what they are going to do with the funding. MCAs very rarely have use restrictions on them, meaning you can get one and then decide how to use the money later. This is especially nice for those in the eCommerce world. Since the supply chain can be unpredictable, it’s great to be flexible with funds.

Here are the pros and cons of an MCA:

Crowdfunding

Crowdfunding has a bad reputation. We’ve all seen GoFundMe horror stories where a company raises thousands – or millions – of dollars for a great idea only to suddenly disappear. But crowdfunding is actually a viable way to secure funds for your eCommerce business.

If you are in the early stages of your business, crowdfunding is a great way to get money simply with a good idea. Other kinds of loans require a strong credit history or a proven business model with lots of revenue.

Popular content

- 14 strategies to improve your eCommerce business’s financial health

- 50+ ChatGPT prompts to elevate your eCommerce business

- A guide to pricing your product on Amazon

- 5 marketing metrics all eCommerce businesses should track

- All about Amazon PPC

Crowdfunding, on the other hand, simply relies on the strength of your business idea. While many small investors giving you money might seem like it would never amount to enough, successful campaigns have shown that even tiny investments can really add up.

That being said, crowdfunding does take some work to get off the ground. Unless you already have a strong community built around your business, you will need to work hard to get the word out. You might need to invest in marketing just to get eyes on your project, and most people won’t invest.

You need something unique about your business in order to succeed with crowdfunding. If you are just another eCommerce shop solely based around profit, no one will want to fund your idea. That means that this funding path only works well for businesses that have something exciting about them. Businesses with great copywriters can also put a spin on an otherwise mundane concept and succeed.

Most crowdfunding sites let you decide whether or not you want to give equity to those who invest. If you want to retain complete ownership of your brand, you can hand out rewards to those who invest instead.

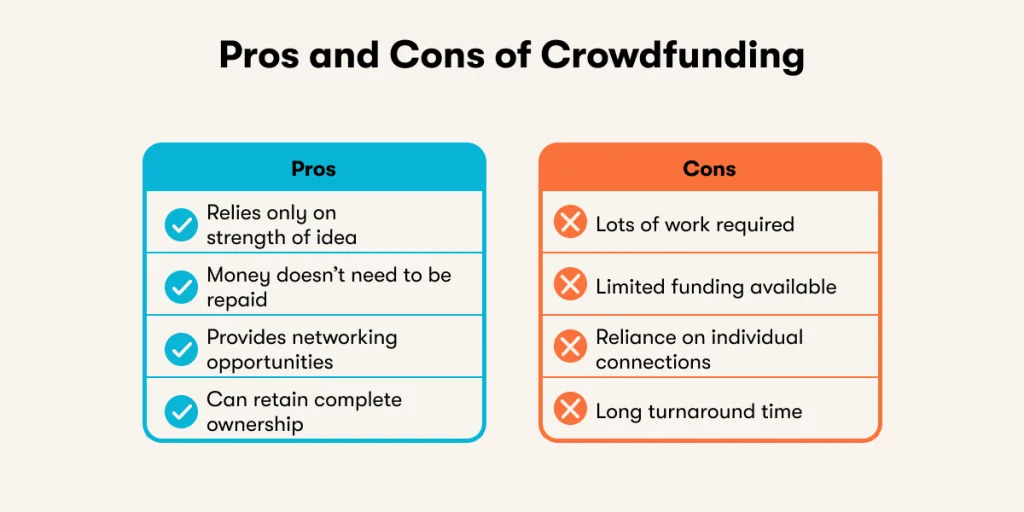

The pros and cons of a crowdfunding approach are pretty straightforward:

Revenue-based funding

Revenue-based financing is another type of funding available to eCommerce businesses. Much like a merchant cash advance, a revenue based funding (RBF) loan is repaid with a portion of the money that a business makes. However, rather than a bit of every single sale being funneled into repaying the loan, RBF loans collect at the end of every month.

This might sound a little intimidating. If you are supposed to pay back a portion of your loan every month using your business revenue, doesn’t that put you at the mercy of your business performance? What if you have an absolutely terrible month and can’t repay the RBF loan?

Don’t worry – most RBF loans actually are paid back based on a percentage of your monthly revenue. In other words, you’ll never have to pay back more than you can afford based on how much you made that particular month.

Most RBF loans are paid back at a cost of somewhere between 5% – 25% of your monthly revenue. Your repayment rate will depend on the terms you negotiate with your specific RBF loan provider. It’s worth shopping around for a good rate.

An application for an RBF loan relies only on your accounting history and business performance. While other funding options require you to show your credit history, that doesn’t matter for an RBF loan. That makes RBF loans appealing for many eCommerce sellers. They are convenient and accessible for nearly everyone that is bringing in a basic amount of revenue.

In addition, if your business is performing well, you can get a pretty sizable RBF loan. The largest loans can reach millions of dollars.

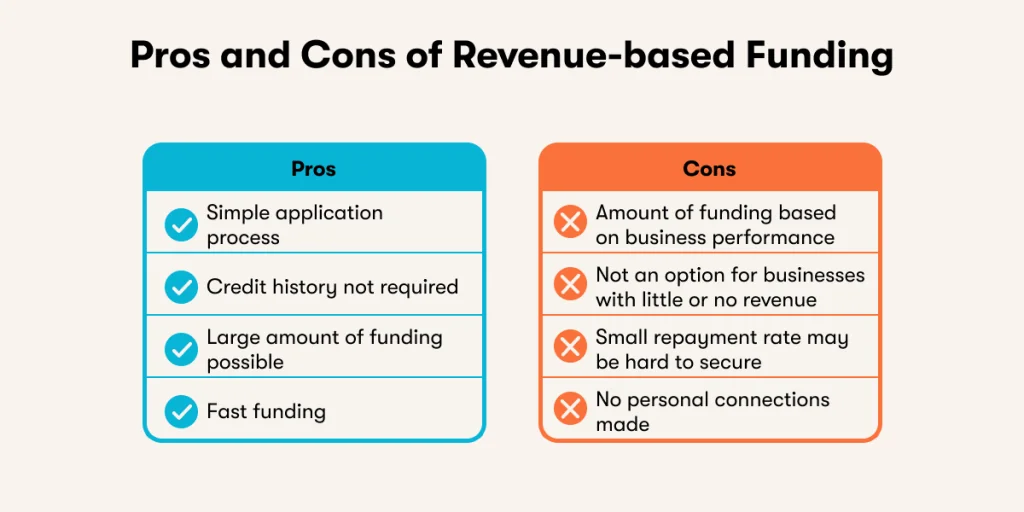

Let’s review the ups and downs of this particular kind of funding:

Business grants

Small business grants are regularly touted as one of the most solid ways to get money. However, they are not easy to secure.

A grant is when a group, often related to the government, decides that it is beneficial to invest money in a business. While grants are often given out for groundbreaking research that will push a certain field forward, organizations also give out grants to businesses that aren’t performing research.

This doesn’t mean that every eCommerce business should write to the government and ask them for a check. While there are certainly grant opportunities available for small businesses, these opportunities are rare. Grants are often intended for projects that have a larger impact than most eCommerce businesses.

Another option is a grant for the business owner. Many small business grants are geared towards uplifting people who might normally struggle to make it in the business world such as women, people of color, or immigrants. If you fall into a minority category, you might have a better chance securing a grant, even if your business isn’t groundbreaking.

It takes research to find a grant that fits you and your business. Once you’ve sourced some relevant options, you then need to apply for them. While some grant applications are pretty simple, others involve extensive in-depth writing. Some businesses even hire grant writers to work on these applications.

You should also consider the fact that some grants have restrictions on fund use. Many grant providers will expect regular reports on how the money is being used. That adds another step, making the grant process a bit trickier.

One of the major benefits of becoming a grant recipient is the fact that it can open up more doors. You get to know the people who are giving you money, and you may even be able to network with past grant recipients.

Oh, and don’t forget: many grants don’t need to be paid back. That’s definitely a plus.

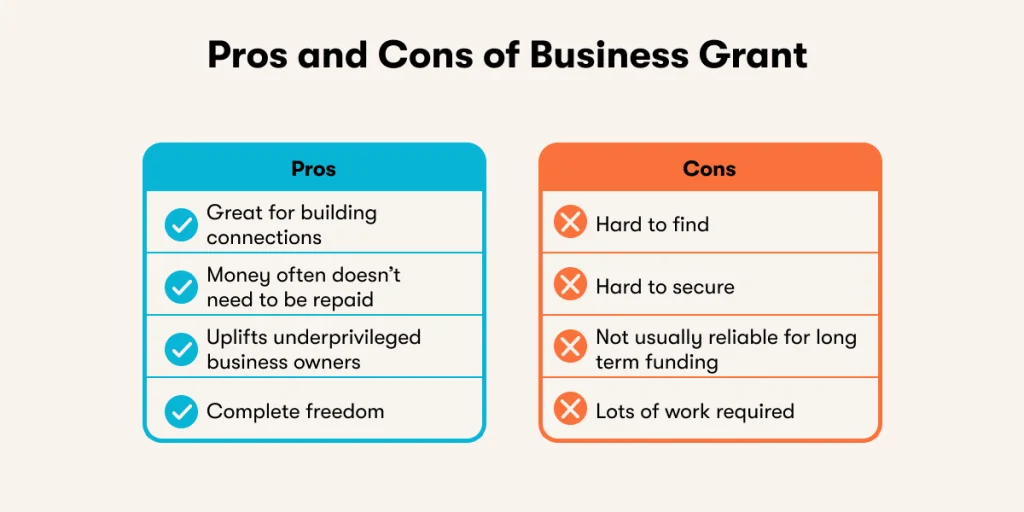

Here are the positives and negatives of getting funding via small business grants:

eCommerce funding companies

As eCommerce becomes a larger industry, more and more companies are throwing themselves at the issue of funding. This is great for business owners. They no longer need to choose traditional funding methods. Instead, they can work with companies that have financing solutions specifically optimized for eCommerce.

Most of these funding companies provide capital to businesses at a cost, much like an MCA. The major difference, though, is that they are specifically looking to finance eCommerce businesses.

There are a lot of reasons why a business owner might want to work with an eCommerce funding company. For one, the way that they give out money is built for the dynamic nature of eCommerce. They understand the constantly shifting nature of the supply chain, and they know that one-time cash infusions do not always work. They tend to offer more flexibility than other funding options.

Another great thing about these companies is that they work very quickly. Unlike a traditional bank loan, these funds get to you fast. Some organizations can even supply a business with money within 24 hours. If you need cash quickly, that type of turnaround time is invaluable.

eCommerce funding companies do have some restrictions, though. First of all, they are likely to consider your business performance. Most require a proven sales history with a pre-determined revenue threshold. This means that your business must be performing well in order to secure the funding. Second, you may have a higher cost of capital with these companies than you would with other funding options. Finally, the application process may be longer than some other options.

These companies exist to help eCommerce businesses, so they can be a great asset if you need funds.

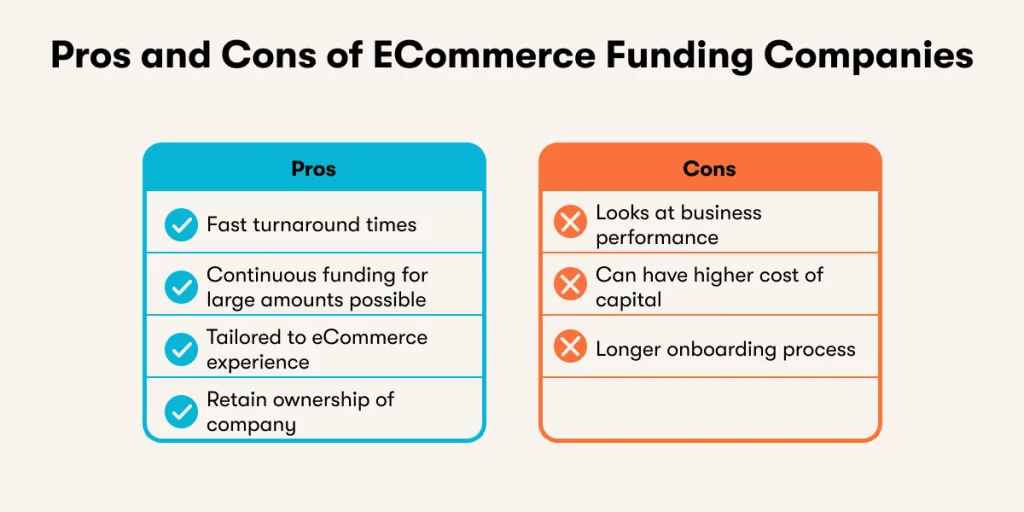

Once again, the pros and cons are:

Comparison of funding methods

There is no “one size fits all” option for eCommerce funding. eCommerce is a diverse industry with lots of different businesses, so it’s up to you to figure out which type of funding best suits your shop. To help you make a decision, let’s compare a few funding methods.

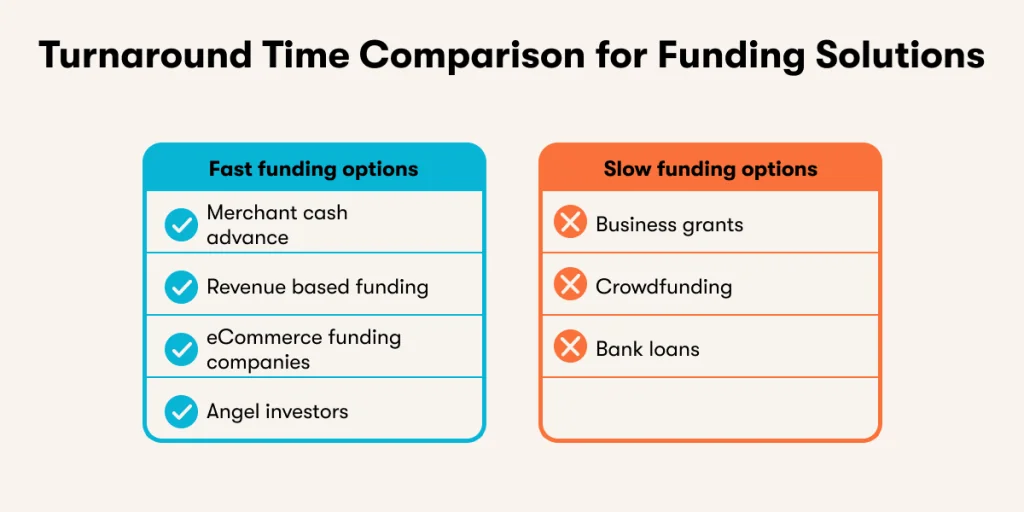

Turnaround time comparison

Let’s begin by comparing these methods based on turnaround time. If you’re already an established shop with plenty of revenue, you may not need funds quickly. That means turnaround time doesn’t need to be a major factor in your decision. For those who need money fast, however, a quick funding method is best.

Let’s start with the slow options. Bank loans, for instance, generally take a very long time. The same goes for crowdfunding. Unless you get very lucky, it’ll take a while for your campaign to really pick up steam. Grants also typically fall into the slow category, as it can take months to hear back after you apply.

The rest of the options we discussed are pretty speedy. Once you connect with a good angel investor, they’ll generally supply you with funds quickly. MCAs and RBF loans are also quite fast. The most reliably fast option, however, is working with an eCommerce funding company.

Let’s break it down with a chart:

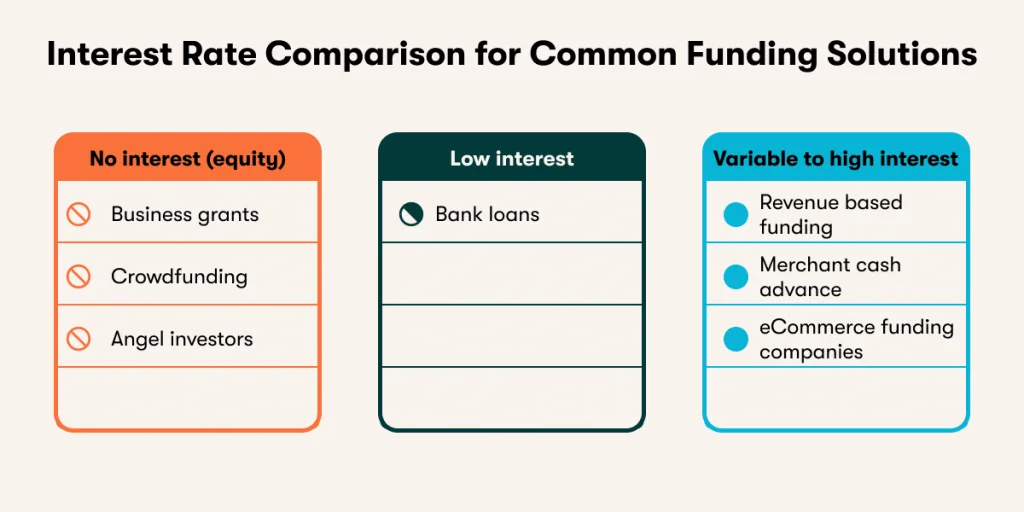

Interest rate comparison

The interest rate of your funding should also be a major factor in your decision. The interest rate is part of what determines how “expensive” a loan is.

There is more that goes into the “price” of the funding than just the interest rate, though. For example, an option like crowdfunding requires an investment in writing and marketing, and that can jack up the total price of the capital.

That being said, the interest rate is a good indicator of how much money you will need to pay to get funding. It’s a good place to start when comparing funding options.

If you want to avoid paying back more than you borrowed – and, in some cases, pay back nothing at all – you should choose crowdfunding, an angel investor, or a business grant. These options don’t require interest on the funding. In fact, you typically don’t even have to pay back the money at all. Angel investors and crowdfunding may require you to give up some equity in your business, though.

There are also options that have a higher cost of capital than those discussed above. This includes RBF, MCAs, eCommerce funding companies, and bank loans. Out of all of these, you can generally expect bank loans to have the lowest interest rates.

Here’s a chart comparing the different funding methods:

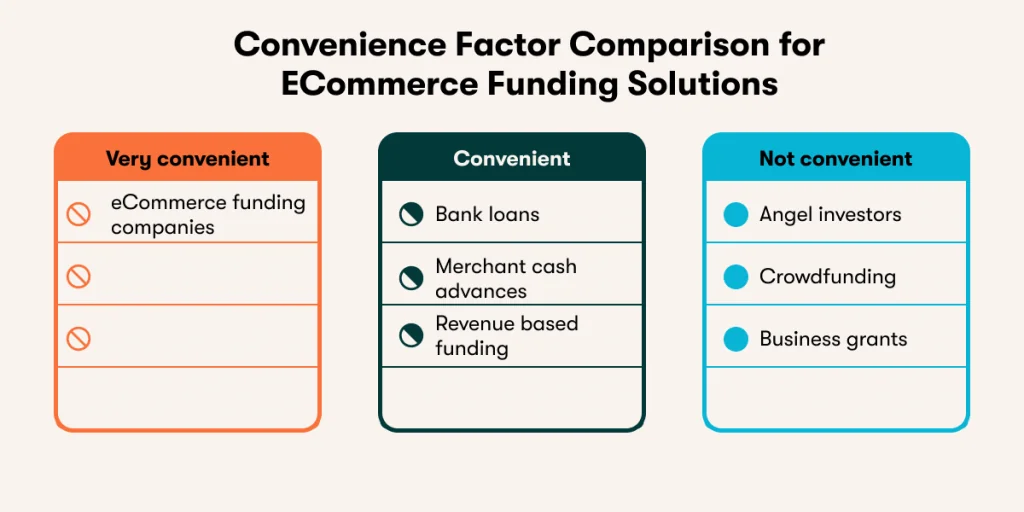

Convenience factor comparison

Convenience is definitely worth thinking about when it comes to picking out a funding option, but it’s a bit of a nebulous concept. What is convenient for some people might not be convenient for others. For example, someone with many high level business contacts might find it easy to secure angel investors. Someone without many connections may find it nearly impossible.

For this comparison, we are going to start with an early-stage eCommerce shop in mind. This shop has had some great growth, but is still more of a side project for the shop owner. They have an average amount of connections, a low amount of free time, and a desire for things to get done quickly and easily.

With that in mind, the most convenient option is an eCommerce funding company. There are a number of options out there, so eCommerce shop owners have many to choose from.

The next tier of convenience contains those that require some work but are still readily available for most sellers. These options aren’t as quick as eCommerce funding companies, but they aren’t going to take too long to pursue. Revenue based funding, MCAs, and bank loans fall into this category.

Then comes the funding platforms that require a great deal of effort. Crowdfunding, for example, takes a long time and a lot of work. Angel investors are also in this category because of the sheer amount of networking required. Finally, business grants may be the least convenient option of all.

Here’s all that information condensed into one easy to understand chart:

Consider 8fig for eCommerce funding

Here at 8fig, we believe that eCommerce founders need a flexible funding solution that lets them take advantage of every opportunity, and gives them grace when things go awry. That’s why we built a Growth Platform that infuses capital at every stage of the supply chain, allowing you to map out your supply chain business plan and then align capital to that plan.

Plus, our change request feature was built specifically for the dynamic nature of eCommerce. Shipping or manufacturing delay? No problem. Simply log in and adjust your Growth Plan.

Don’t just take it from us, though. Here are three eCommerce founders who forged a future without limits using 8fig funding.

Jerry and Alex sold their Amazon brand for multi 7-figures

Brand building and flexible funding helped this couple achieve their dream of financial freedom. “Selling was the pot at the end of the rainbow,” said Alex. “It’s amazing to have our dream come true.”

Glitch turned down VC funding to scale with 8fig and keep full ownership

The founders of Shopify brand Glitch Energy didn’t want a boardroom directing their business plans from the earliest stage of their business. After hearing about 8fig, they used the flexible funds to scale from 0 to 7-figures in year 1, all while keeping autonomy and equity.

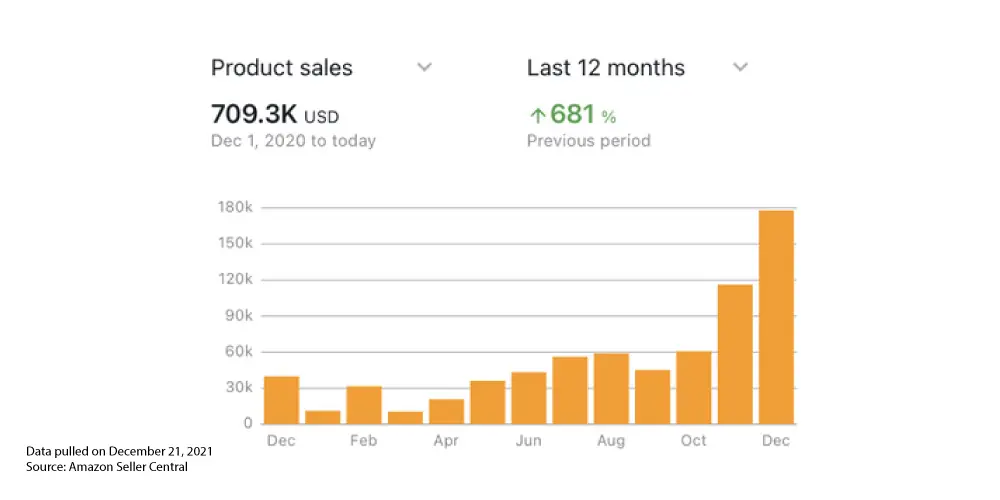

Alex and Aidan scale Amazon sales 7x with 8fig, plan for multi-7 figures in 2022

This young family scaled their brand nearly 7x in one year. Getting large disbursements from 8fig helps them save costs by ordering inventory in batches, plus they can stay nimble as things change. Now, they’ve achieved freedom and fulfillment as the young family lays building blocks for wealth to last generations.

The best platform for you depends on your business plan and your growth ideas. One thing is certain, though. If you want to build up your shop and start making even more money, there are a lot of options out there to secure funding.

Have article ideas, requests, or collaboration proposals? Reach out to us at editor@8fig.co – we’d love to hear from you.

- Financing solutions for Amazon sellers

- Personalization in eCommerce: How to drive conversions and retain customers

- 8 proven strategies to boost your Lunar New Year eCommerce sales (with actionable tips)

- 6 reasons content marketing beats PPC for eCommerce

- Expert tips: How to navigate Chinese New Year shipping delays

Subscribe to the eCommerce newsletter for

top industry insights

to our blog

Read the latest

from 8fig

Learn how to fine-tune your supply chain for the holiday season with expert tips on forecasting demand, managing suppliers, and optimizing logistics. This guide is here to help you avoid common pitfalls and set your eCommerce business up for success during peak periods and beyond.

Video ads can make or break your eCommerce success. Learn five essential strategies to create high-converting campaigns that captivate and convert.

Personalization isn’t just a trend – it’s the key to eCommerce success. Discover how tailored strategies drive conversions, foster loyalty, and set your store apart.